Obtain valuable first-party data with instant rewards

ACQUIRE & ACTIVATE

Obtain valuable first-party data with instant rewards

At Perx, we revolutionize customer engagement by empowering brands to unlock the power of data-driven personalization

Amrith G, SVP | Marketing & Customer Analytics

Journey Popularity Index: ![]()

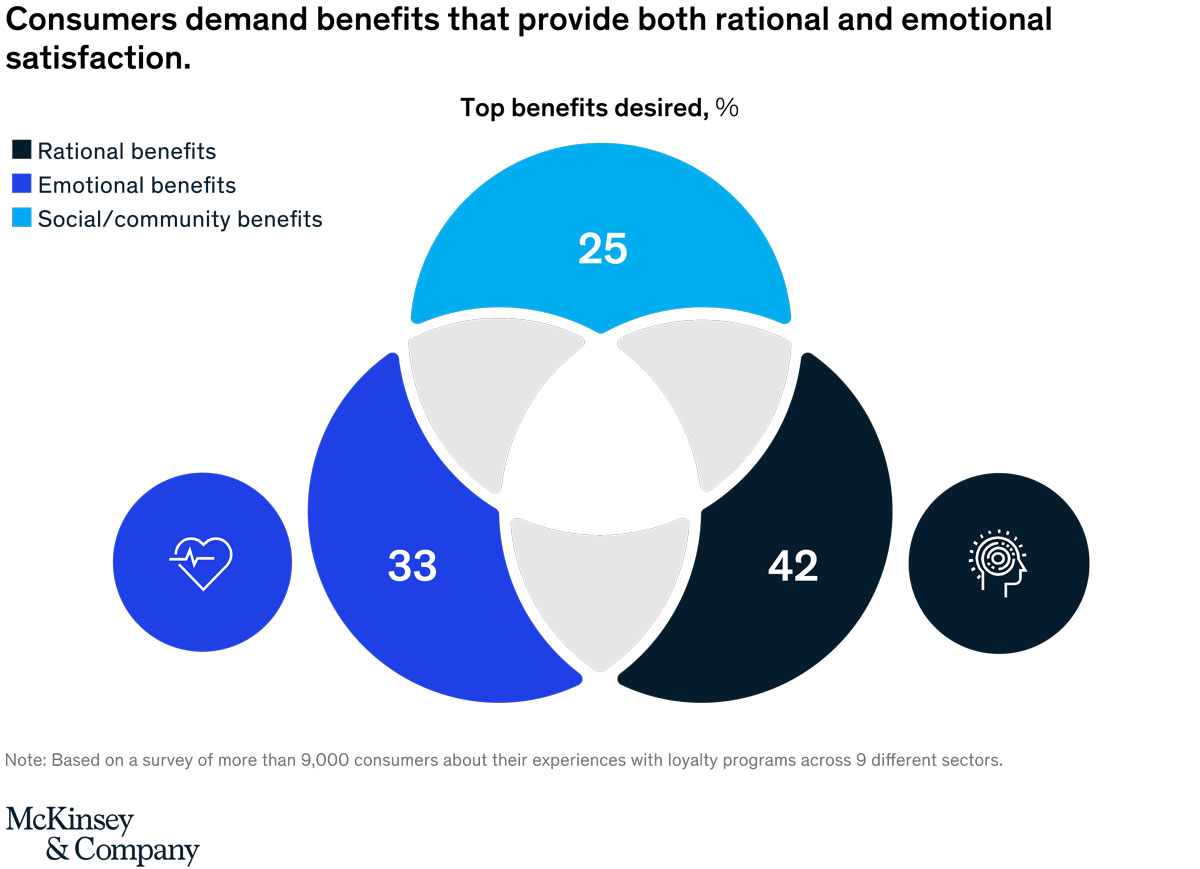

The Rationale

Incentivizing users to share their preferences and utilizing that data for personalized targeted offers and subscriptions creates a win-win situation for both brands and customers. By gathering detailed insights into customer preferences, brands can tailor their offerings to align with individual needs and desires, enhancing the overall customer experience which fosters stronger brand-consumer connections

The Benefits

Delivering personalized offers and subscriptions based on individual preferences allows brands to provide customers with relevant, timely, and tailored experiences. This increases customer satisfaction and engagement, as users feel understood and valued by the brand. This also allows/enables brands to allocate resources more effectively

Industry: Telecom, Travel & Hospitality, Media & Entertainment, Financial Services

Customer base: >100k users

Mobile app: Not Required

Conversion rate, customer acquisition cost, incremental revenue, attribution analysis

Consult with us to learn how you can transform your mobile first customer journeys

Incentive-led First-Party Data Collection

Peter sees a Facebook ad requesting him to answer a few questions in exchange for an instant reward

ACTION 1: Perx Powered Survey

Enticed by the reward, Peter completes the survey, answering preferential and behavioral questions

Instant Gratification

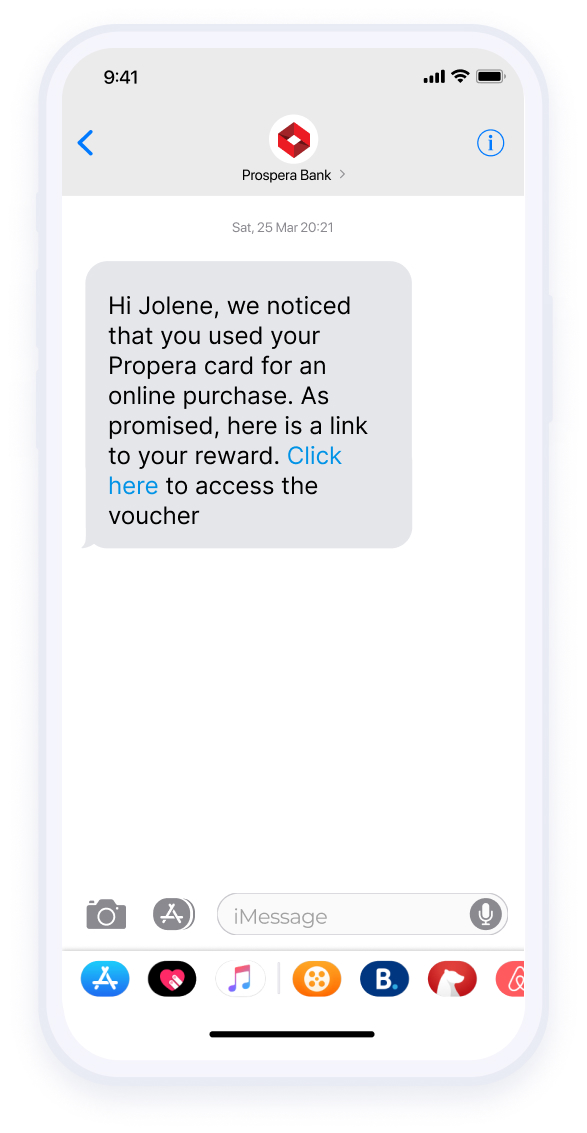

Upon submitting the survey, Peter instantly receives an SMS with a unique link to access his reward

Perx Powered New Customer Acquisition

A Facebook ad is served to Peter, with a personalized offer based on his preferential data captured in the survey. The personalized offer lures him to sign up for the app

ACTION 2: Download and Install

Motivated by the tailored offering, Peter downloads the app and signs up for an account

ACTION 3: Phone Number Verification

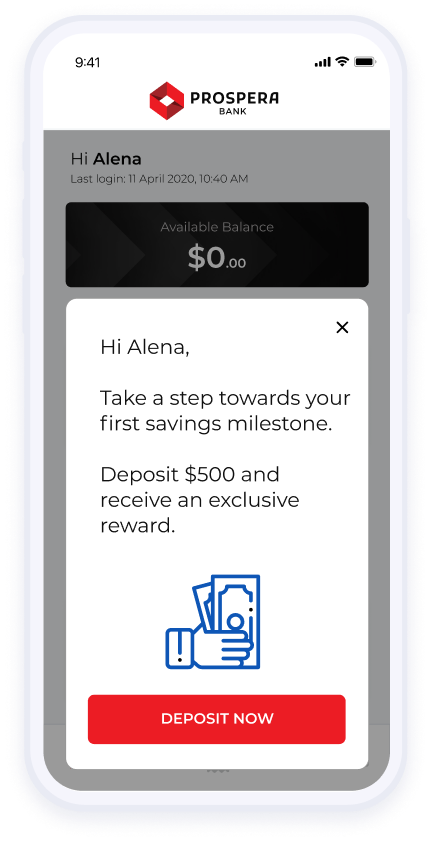

Peter is prompted by an instant reward campaign to verify his contact details

CUSTOMER ACQUIRED

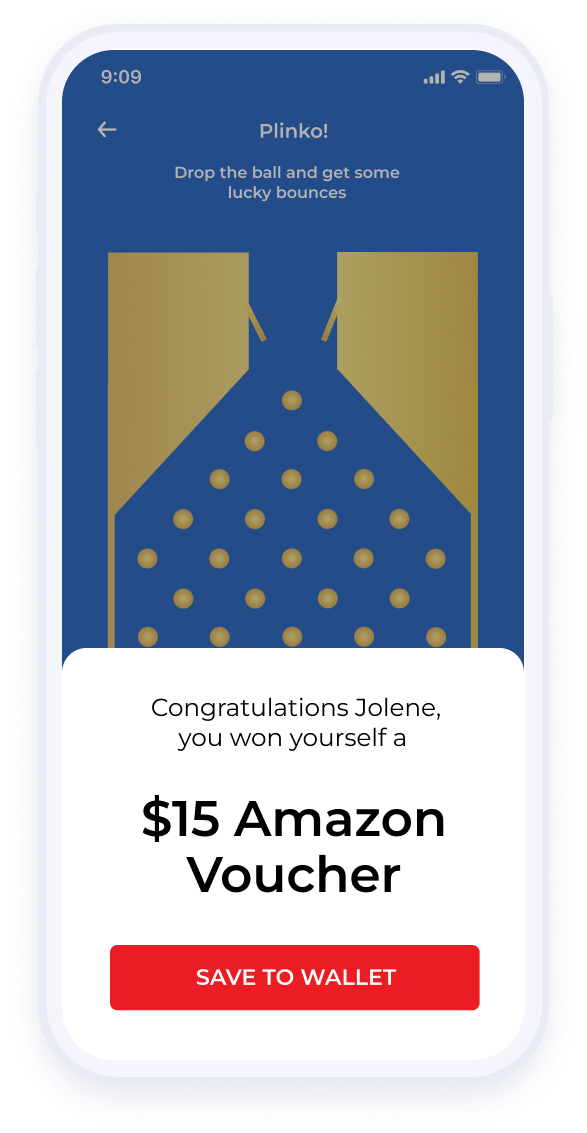

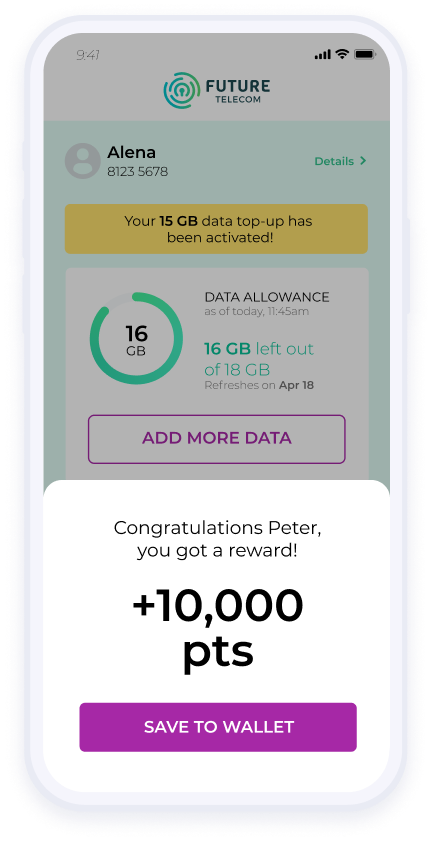

Instantly Rewarding Customer Action

Upon verification, Peter is presented an instant reward for completing the action

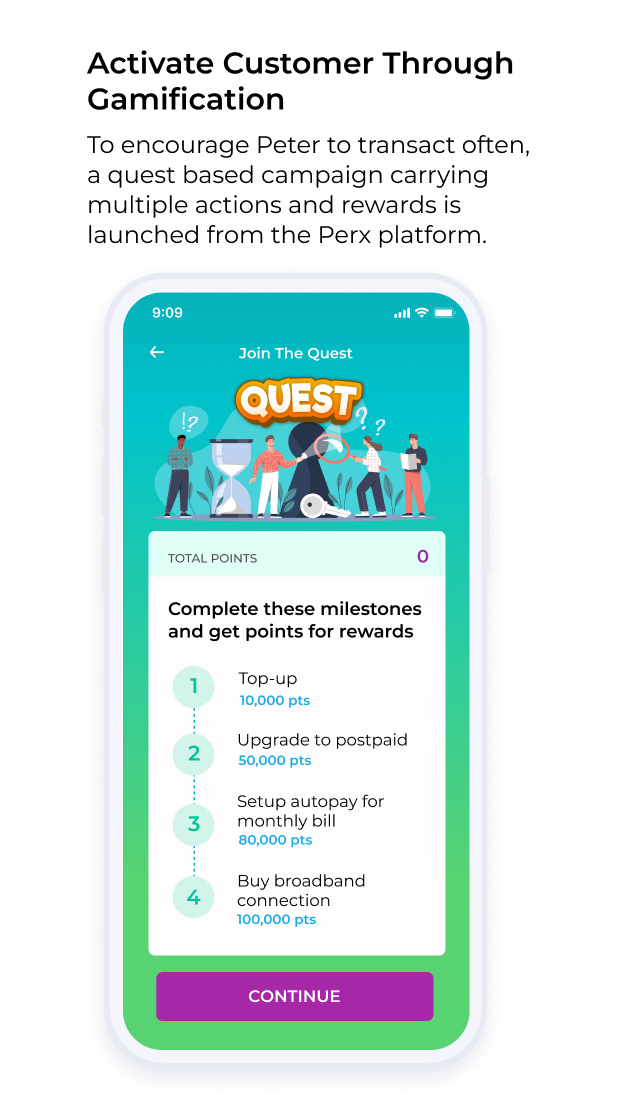

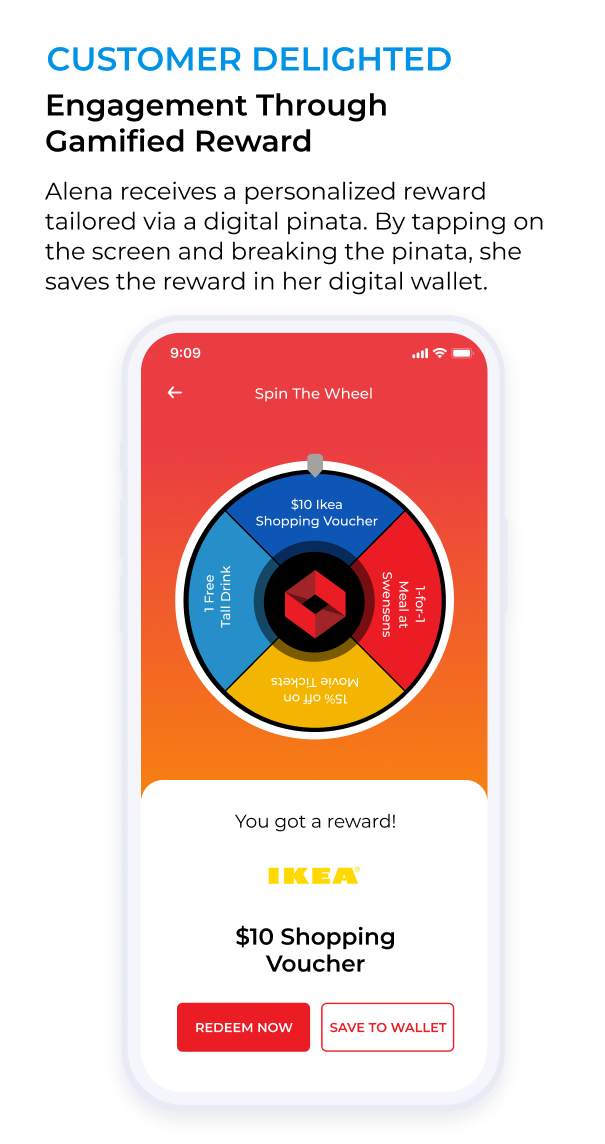

Activate Customer Through Gamification

To encourage Peter to transact often, a quest-based campaign carrying multiple actions and rewards is launched from the Perx platform

ACTION 4: Transact

Peter completes the first action in the quest series - A prepaid mobile phone top-up through the app

CUSTOMER ACTIVATED

Instantly Rewarding Customer Action

Peter is instantly rewarded with loyalty points for completing his first milestone

Milestone Completed

Peter is excited about being rewarded instantly for the action he completes. Peter is all set to complete his next milestone

Success With Another Peter

Insights from the survey are leveraged to target and engage thousands more with tailored messaging and relevant content

Explore more Use Cases

-

Incentive-led First-Party Data Collection

Peter sees a Facebook ad requesting him to answer a few questions in exchange for an instant reward

-

ACTION 1: Perx Powered Survey

Enticed by the reward, Peter completes the survey, answering preferential and behavioral questions

-

Instant Gratification

Upon submitting the survey, Peter instantly receives an SMS with a unique link to access his reward

-

Perx Powered New Customer Acquisition

A Facebook ad is served to Peter, with a personalized offer based on his preferential data captured in the survey. The personalized offer lures him to sign up for the app

-

ACTION 2: Download and Install

Motivated by the tailored offering, Peter downloads the app and signs up for an account

-

ACTION 3: Phone Number Verification

Peter is prompted by an instant reward campaign to verify his contact details

CUSTOMER ACQUIRED

-

Instantly Rewarding Customer Action

Upon verification, Peter is presented an instant reward for completing the action

-

Activate Customer Through Gamification

To encourage Peter to transact often, a quest-based campaign carrying multiple actions and rewards is launched from the Perx platform

-

ACTION 4: Transact

Peter completes the first action in the quest series - A prepaid mobile phone top-up through the app

CUSTOMER ACTIVATED

-

Instantly Rewarding Customer Action

Peter is instantly rewarded with loyalty points for completing his first milestone

-

Milestone Completed

Peter is excited about being rewarded instantly for the action he completes. Peter is all set to complete his next milestone

-

Success With Another Peter

Insights from the survey are leveraged to target and engage thousands more with tailored messaging and relevant content

Ready to join them?

Feedback From

Our Customers

"I gotta say, I'm really surprised - I was able to create a loyalty program in just one minute!"

"The platform is incredibly user-friendly, making it easy for businesses to create and launch loyalty programs that really work"

"The solution offers unmatched flexibility, allowing businesses to customize their loyalty programs to align with their unique needs and brand identity"

"The platform helps drive more meaningful customer engagements, enhance stickiness, improve NPS & thus increasing revenue incrementally for our brand"

"Having delivered real world results in customer engagement, Perx is perfectly suited to accelerate & extend our creative & cutting edge innovation"

in 4 weeks

100 days

Leading telecom serving 90M customers boosts customer actions through gamification.

revenue in 100 days

15M brand interactions created

Leading bank engages 4M+ customers with 15M interactions in one year.

25%

221K

actions and interactions

Over $18M in incremental revenue

Leading bank increases overseas spending by high-end credit card customers.

4.8M

Recommended for you

Customer Acquisition, First-Party Data, Instant Gratification

Strategy Insights, Blogs, Retailers

Customer Engagement, Gamification, Customer Acquisition

Customer Engagement, Customer Acquisition, Brand Awareness

Customer Engagement, Customer Acquisition, Brand Awareness