Feasting on a long-lasting connection with your customers

Feasting on a long-lasting connection with your customers

According to Oxford University researchers, a tiger’s brain is sixteen percent larger than a lion’s. As a result, Tiger is now widely believed to be the jungle king, contrary to what we were taught in school.

Just as people have traditionally believed that the lion was the king of the jungle, brands have always assumed that customer acquisition was paramount, and that customer retention was irrelevant. The reality, however, has been quite the opposite.

Businesses in the United States lose $136.8 billion annually due to poor customer retention.

Customer retention isn’t hard to achieve; it’s just that brands rarely put up the effort to hit hard where it counts.

When you don’t prioritize customer retention, you’re a sitting duck waiting to get devoured by your competition, who, by the way, has been listening to the sounds of the jungle and is ready to attack when you’re least expecting it.

Have a tiger in your tank.

Customer loyalty initiatives that delighted Baby Boomers and Generation X are not enough to excite the brands’ generations. Today’s loyalty programs perform better when tailored based on previous transactions and customer data. Sixty-four percent of customers expect personalized customer experiences based on previous transactions.

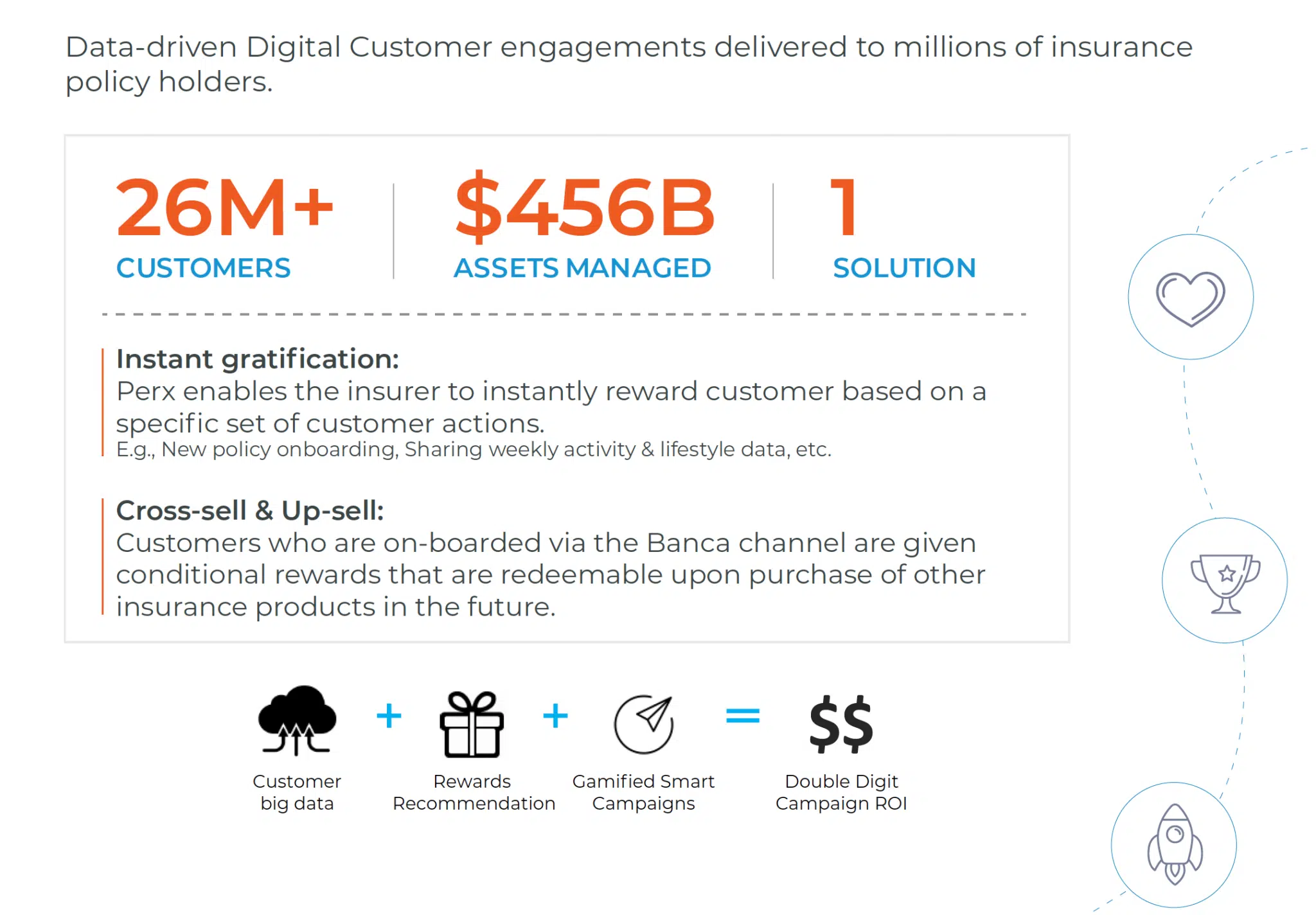

That is precisely what Perx Platform enables you to achieve. To begin, it detects the specific customer behaviors that contribute to your revenue. Second, it finds the incentives that will motivate your customers to take action. Third, it transforms your static digital efforts into dynamic, interactive, data-driven experiences. Finally, gamified rewards make customers feel good about what they do right away.

Don’t have a tiger by the tail.

Companies are frequently attracted to build software in-house to address complicated business challenges. However, while cost, control, connectivity, and maintenance are all reasons why businesses choose to develop software in-house, this is not always the prudent course of action. According to Gallup, one out of every six IT projects had a cost overrun of 200 percent and a schedule overrun of about 70 percent.

Perx is aware of the issue. That is why its industry-leading approaches such as Continuous Integration & Continuous Delivery (CI/CD), automation testing, and dockerization have become industry standards in the SaaS arena. At Perx, we take innovation and delivery to the next level by setting up our technologies and teams and rapid development procedures. We take pleasure in co-innovating to solve difficulties for our partners and clients in a matter of weeks.

When in doubt, ride a tiger.

Customers are more likely to leave if you take a reactive rather than proactive strategy. Find out what your lost customers are complaining about, and modify your product, pricing, or positioning to address their concerns. Analyze the trend if many people leave at a given moment. Collect feedback, centralize it, and figure out why most of them are going.

Fifty percent of millennials said they dropped out of a loyalty program because the rewards took too long to accumulate. In a fast-changing digital economy, traditional static loyalty and rewards programs are no longer effective. They are expensive to maintain and have become a liability for companies worldwide, negatively impacting profitability.

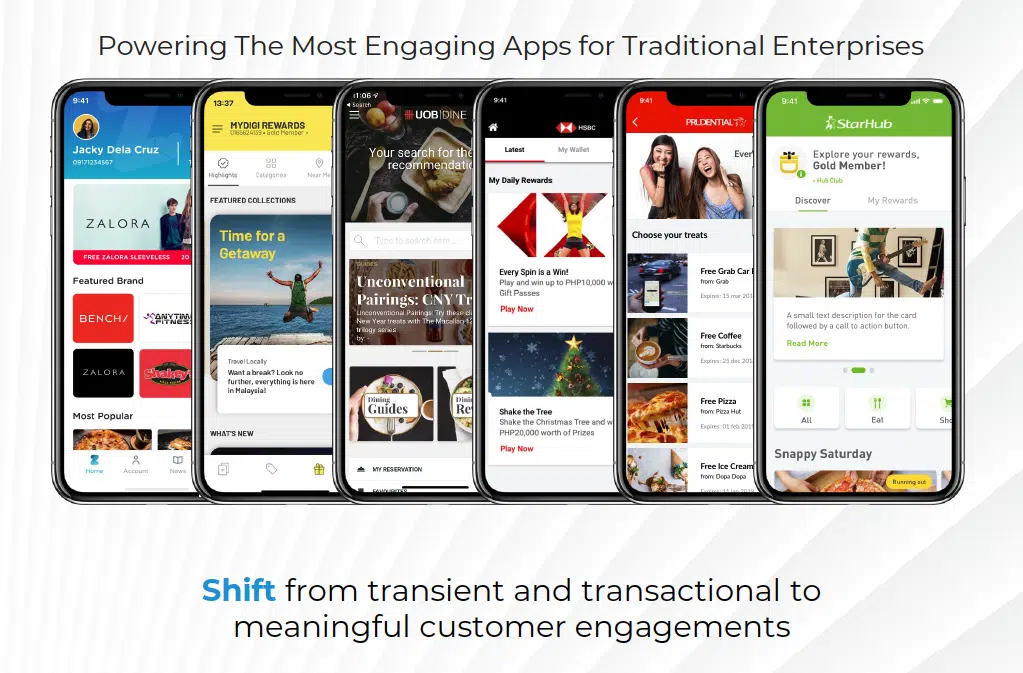

Customers today have a lot of expectations. Perx believes that how businesses interact with consumers and ecosystem partners needs to be rethought as their behavior constantly changes. Perx’s LMP is built to help brands move from being short-term and transactional to delivering meaningful relationships to millions of customers and partners worldwide.

If you want to be the new king, don’t just roar, roar to conquer.

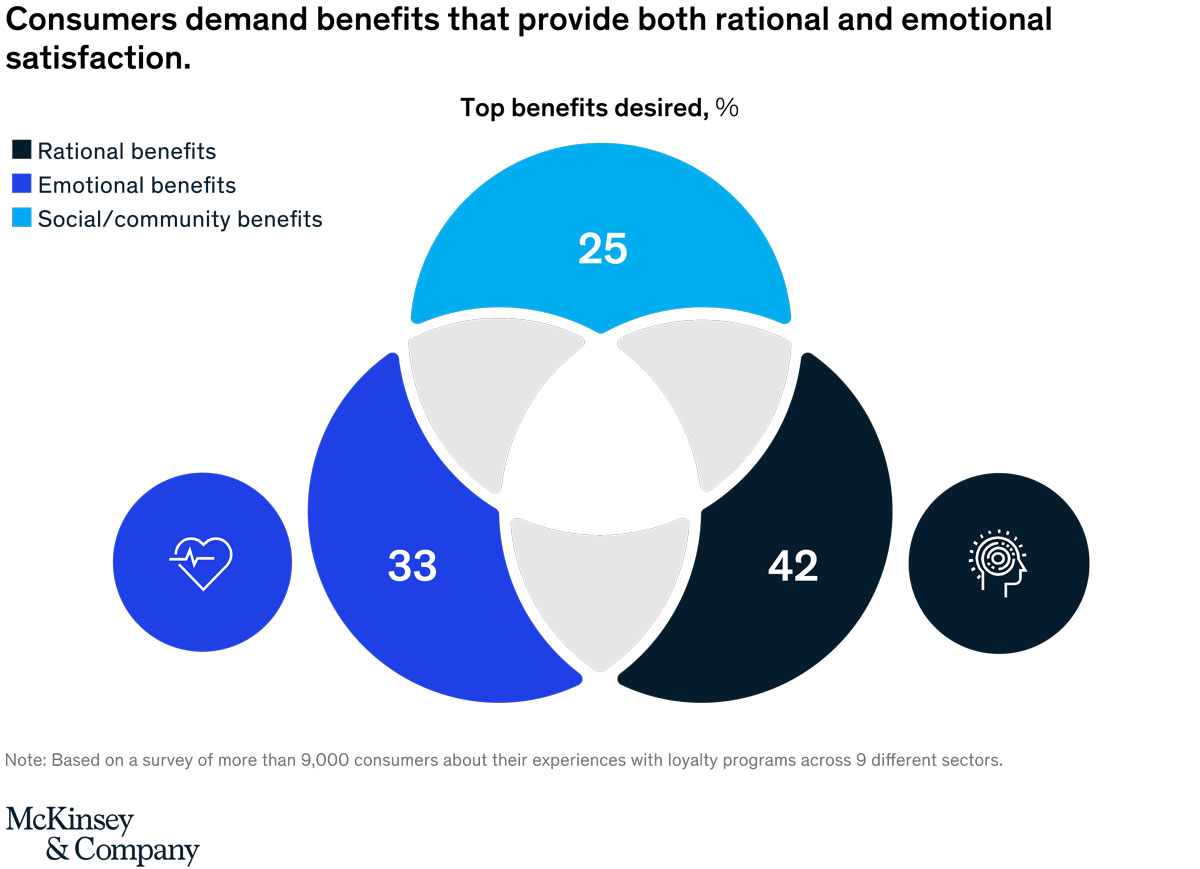

70% of brands having a loyalty program do not allow customers to choose their favorite reward.

When you reward a customer, you are appealing to their emotional side. By doing so, you begin the process of developing a bond. As time goes on, they’ll regard you as more than just a product! As a result, it increases customer loyalty, encouraging repeat purchases that increase your revenue. This means you have to give them what matters to them and not what matters to you.

The majority of loyalty programs have the same goal: to keep consumers, increase customer lifetime value, and demonstrate appreciation. The customer’s last-mile journey is crucial to any engagement strategy. Finally, the platform extends this last mile by engaging customers in dynamic, gamified, and incentive-driven engagements that encourage them to do the actions and transactions they were truly aiming for. Additionally, Perx has established the Rewards Marketplace, which features an extensive curated range of retailer rewards that are linked with the digital consumer’s lives. Brands can respond to the quick gratification trend by rewarding customers for their behaviors through customized lifestyle rewards in only three simple clicks. Furthermore, organizations that want to launch their own in-app mobile commerce store and create a new revenue stream can do it without making significant investments or allocating essential resources.

Recommended for you

Blogs

Sustainability

Blogs

Blogs

Blogs

Global businesses have driven over 5 billion customer-brand interactions on Perx.

Ready to join them?

Every Saturday from 9:00 a.m. to 3:00 p.m., customers could spin the Wheel of Treats for a chance to win at StarHub Snapping Saturday.

Every Saturday from 9:00 a.m. to 3:00 p.m., customers could spin the Wheel of Treats for a chance to win at StarHub Snapping Saturday.

If you want customers to adopt your brand, you need to adapt to their lifestyle choices.

If you want customers to adopt your brand, you need to adapt to their lifestyle choices.

In fact,

In fact,