Secure customers and influence actions through dynamic experiences

ACQUIRE & ACTIVATE

Gather user preferences and tailor experiences accordingly

This interactive journey synergizes gamification and personalization to engage customers

Elia Wagner, CX Architect

Journey Popularity Index: ![]()

The Rationale

This interactive journey synergizes gamification and personalization to engage customers like Sarah from the beginning. It increases the chances of successful acquisition and activation while driving organic growth through referrals and social sharing.

The Benefits

Supercharge your business’s ability to acquire, activate, engage, retain, and monetize customers, ultimately leading to increased success.

Ideally Suited For

Industry: Telecom, Banking, Large-Retail

Customer base: > 50k customer base

Mobile app: Yes

Existing Loyalty program: Not a must

Key Performance Indicators

Customer acquisition, customer engagement, customer retention

Perx-Powered Referral Message

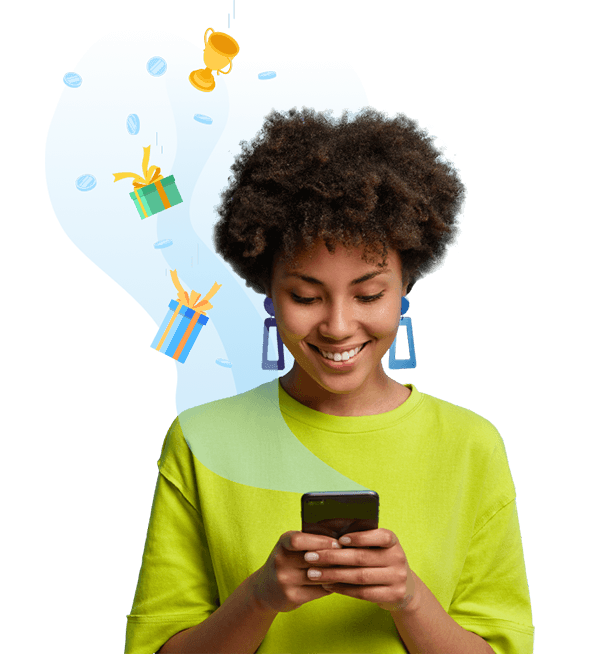

Sarah receives a personalized invitation from a friend, highlighting the benefits and rewards of joining Prospera Bank

Download & Sign-Up

Sarah creates an account with Prospera Bank, beginning her journey towards a seamless and innovative banking experience. The code is seamlessly auto-populated from her unique link

KYC Verification

Sarah verifies her identity through Prospera Bank's secure, efficient and streamlined KYC process

CUSTOMER ACQUIRED

Gamified Engagements

Sarah is then introduced to a series of interactive missions designed to engage and familiarize her with the bank's offerings and to complete the first few revenue generating activities

Customer Action: Personal Interest Survey

After the KYC, Sarah is asked to share her personal interests, allowing Prospera Bank to provide tailored banking experiences

Reward for Sharing Preferences

Sarah is congratulated for successfully completing all missions, emphasizing her progress and achievements, and is presented with her reward

CUSTOMER ACTIVATED

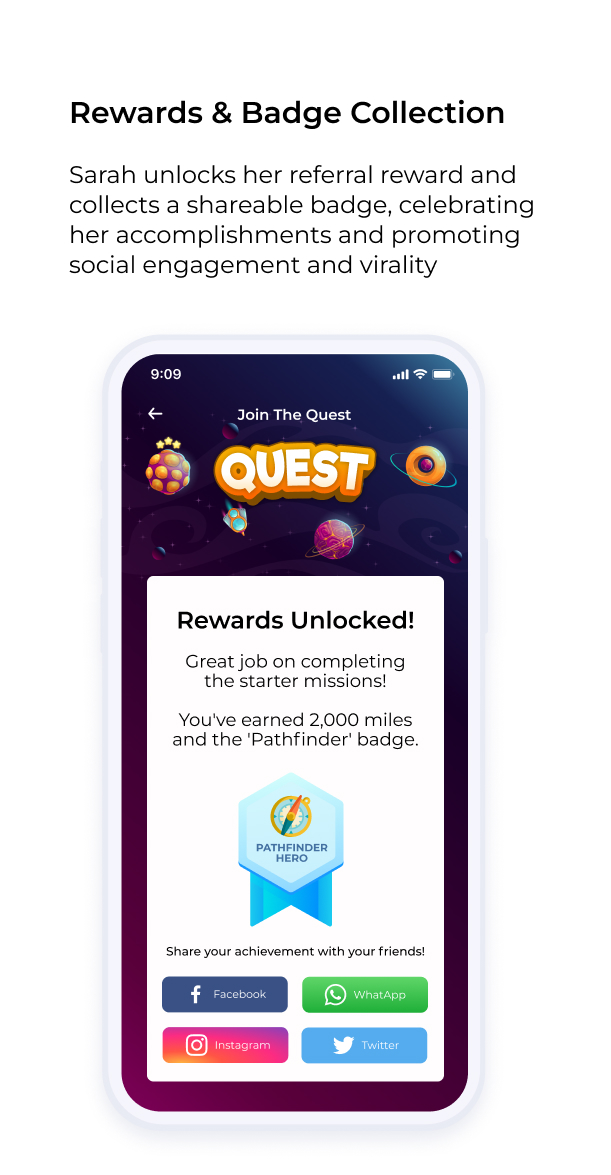

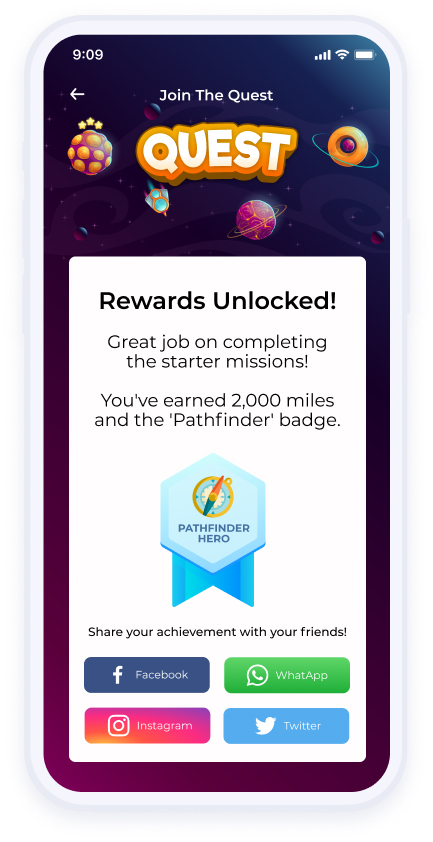

Rewards & Badge Collection

Sarah unlocks her referral reward and collects a shareable badge, celebrating her accomplishments and promoting social engagement and virality

Explore more Use Cases

NEXT: Explore other Journeys below

Explore more Use Cases

Ready to join them?

Feedback From

Our Customers

"I gotta say, I'm really surprised - I was able to create a loyalty program in just one minute!"

"The platform is incredibly user-friendly, making it easy for businesses to create and launch loyalty programs that really work"

"The solution offers unmatched flexibility, allowing businesses to customize their loyalty programs to align with their unique needs and brand identity"

"The platform helps drive more meaningful customer engagements, enhance stickiness, improve NPS & thus increasing revenue incrementally for our brand"

"Having delivered real world results in customer engagement, Perx is perfectly suited to accelerate & extend our creative & cutting edge innovation"

in 4 weeks

100 days

Leading telecom serving 90M customers boosts customer actions through gamification.

revenue in 100 days

15M brand interactions created

Leading bank engages 4M+ customers with 15M interactions in one year.

25%

221K

actions and interactions

Over $18M in incremental revenue

Leading bank increases overseas spending by high-end credit card customers.

4.8M

Recommended for you

Customer Acquisition, First-Party Data, Instant Gratification

Strategy Insights, Blogs, Retailers

Customer Engagement, Gamification, Customer Acquisition

Customer Engagement, Customer Acquisition, Brand Awareness

Customer Engagement, Customer Acquisition, Brand Awareness