An ISO/IEC27001:2013 and ISO 27018:2019 certified cloud solution

© 2025 Perx Technologies. All rights reserved.

Home > In The News >

SINGAPORE, July 23, 2024 – PRESS RELEASE

New Collaboration to Leverage AI and Data Insights, Enhancing Customer Loyalty and Financial Wellness Across Key Regions.

Strands, a leading provider of AI-driven financial management solutions, is pleased to announce a strategic partnership with Perx Technologies, the world’s first intelligent and autonomous customer engagement and loyalty solution provider. This collaboration aims to integrate Strands’ advanced financial management capabilities with Perx’s AI-driven customer engagement and loyalty platform, Connect+. This synergy will empower financial institutions across APAC and the Middle East to deliver a personalized, seamless, and data-driven experience that enhances customer loyalty and financial wellness.

The Objective of the Partnership

The partnership between Strands and Perx Technologies seeks to revolutionize the financial services landscape by leveraging Strands’ data analytics and AI capabilities with Perx’s autonomous loyalty engagement platform. This synergy will deliver personalized, engaging, and gamified experiences, fostering increased loyalty and deeper customer relationships for financial institutions.

Strands will utilize its advanced data analytics to create gamified journeys, clustering users into specific audiences based on relevant metrics and triggering engagement events. Perx will respond to these triggers with fun, meaningful, and hyper-personalized campaigns including incentives and rewards from partnering merchants to drive more transactions. These micro-experiences ensure each interaction is instant, engaging, and enjoyable, leading to increased customer lifetime value.

“Integrating personal financial management data into loyalty and engagement campaigns is a game-changer. It allows brands to roll out hyper-personalized in-app engagements that empower customers to make smarter financial decisions while enhancing their engagement with the respective financial institutions,” said Anna Gong, Founder & CEO of Perx Technologies. Sharing the vision for this partnership, she added, “This partnership with Strands will not only elevate the customer experience but also drive deeper loyalty and higher lifetime value. At Perx, we believe that by leveraging the power of financial data securely, we can empower our clients to create meaningful, lasting relationships with their customers, positively improve consumer financial behavior, and fuel growth for our clients across industries.”

Benefits to Financial Institutions

“We are thrilled to partner with Perx Technologies to bring a new level of personalization and engagement to the financial services industry. By combining our AI-driven financial management solutions with Perx’s innovative loyalty platform, we can help financial institutions create more meaningful interactions with their customers. This collaboration will enable us to deliver highly personalized and engaging experiences that drive customer loyalty and financial wellness,” said Edoardo Borsari, Managing Director of Strands.

About Strands

Strands is a global leader in AI-driven financial management solutions, providing innovative tools that enable banks and financial institutions to deliver personalized customer experiences and deepen their customer relationships.

About Perx Technologies

Perx is the world’s first intelligent and autonomous solution for customer engagement and loyalty. Powered by AI and data-driven insights, the Perx Connect+TM Loyalty Engagement Platform enables brands to engage customers in ways that are both deeply meaningful and monetizable. Headquartered in Singapore, the platform synergizes gamification, behavioral science, and advanced engagement mechanics to support brands in elevating customer actions and interactions using data-driven experiences.

By designing customized, incentive-driven journeys, Perx Technologies simplifies customer acquisition, activation, monetization, and growth, cultivating enduring loyalty and remarkable user experiences, and solidifying its position as an industry trailblazer. The API-first platform enables businesses to focus on use cases and creative engagements across a brand’s disparate marketing technology stack in a matter of minutes.

Home > In The News >

SINGAPORE, June 11, 2024 – PRESS RELEASE

PT Bank BTPN Tbk (Bank BTPN) is spearheading the bank’s mobile-led consumer banking services with its flagship Jenius, as pioneer of digital banking in Indonesia.

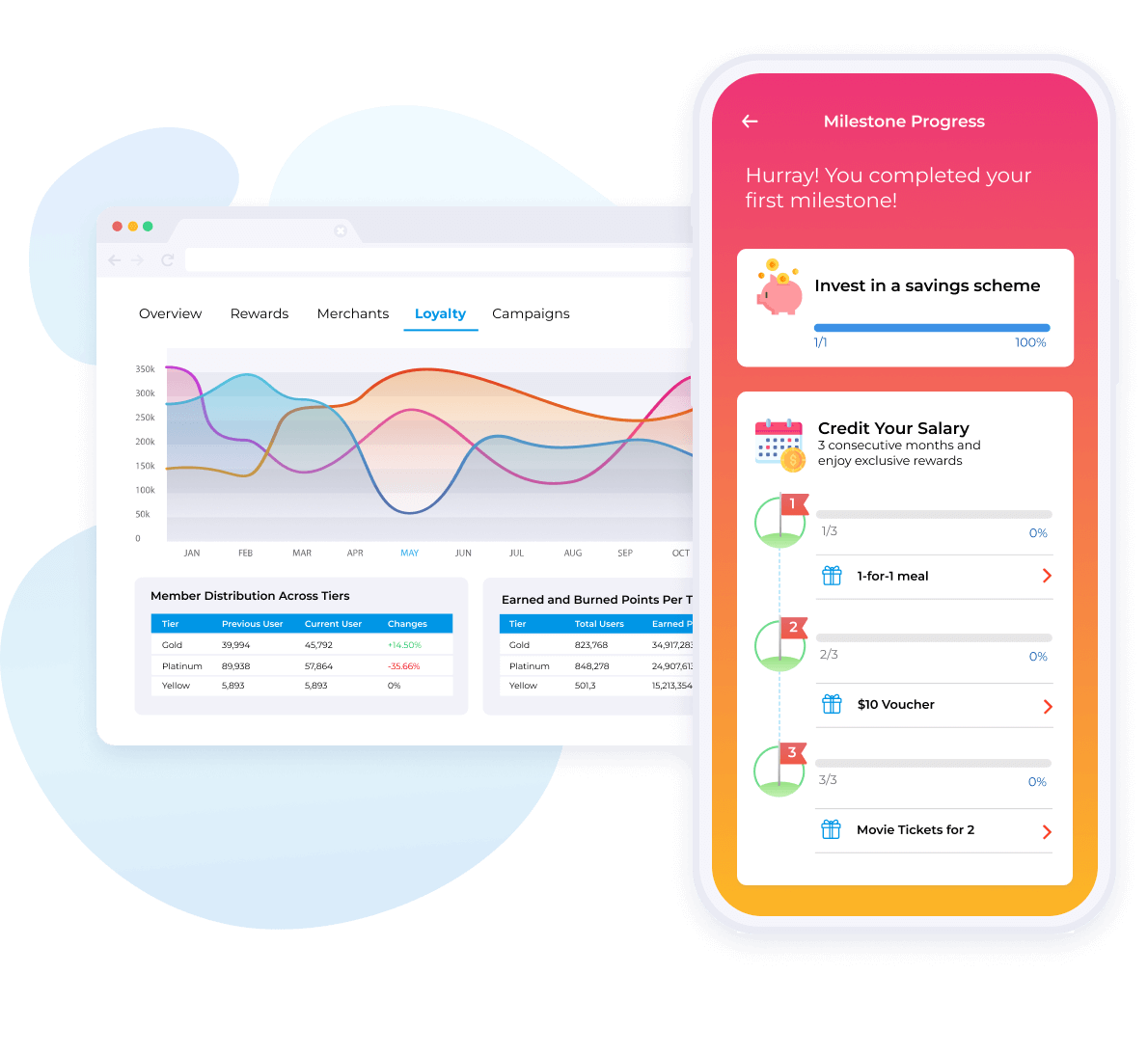

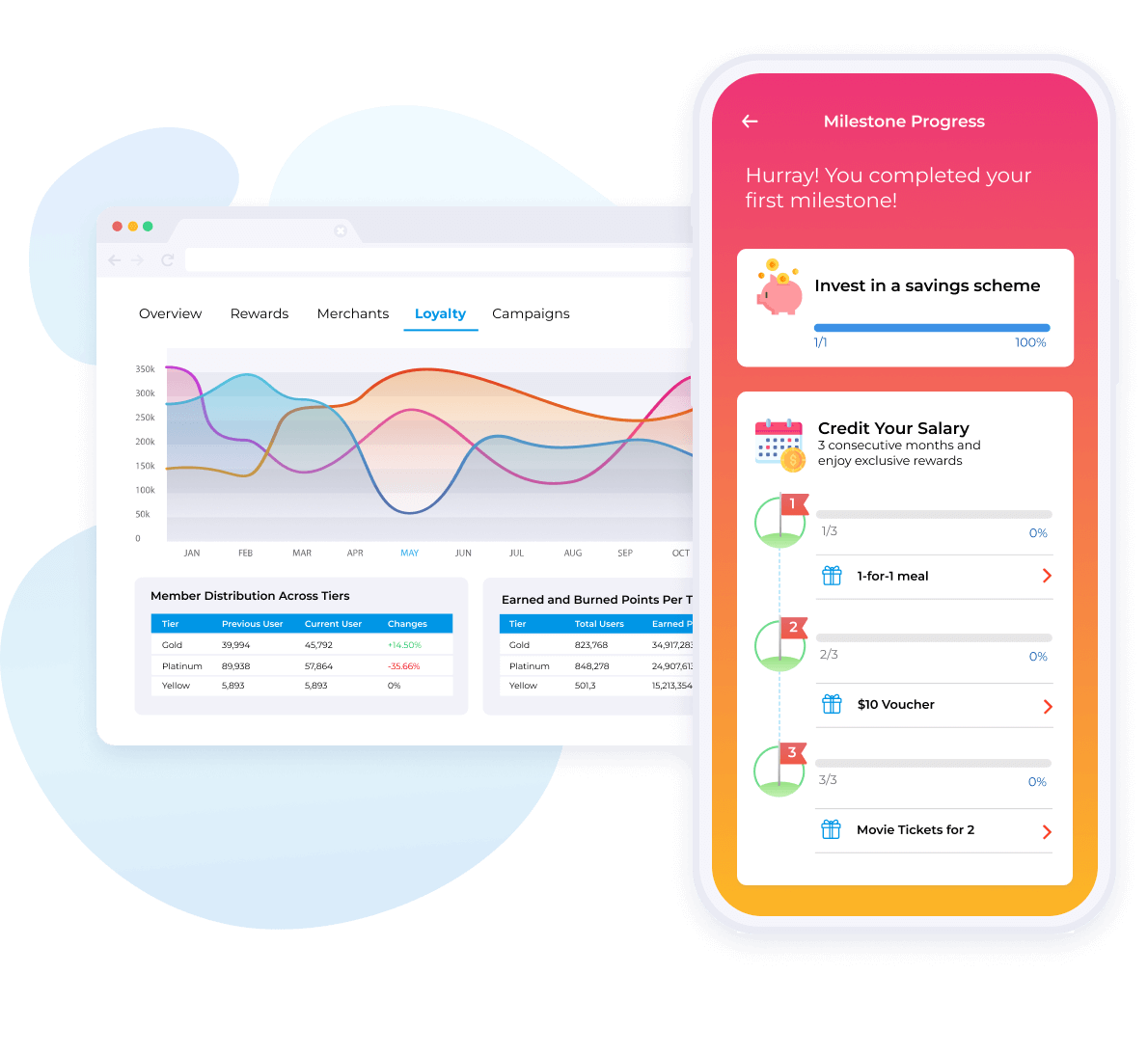

Jenius has partnered with Perx Technologies to transform traditional banking experiences that are purely driven by needs and wants to a fun and game-like experience.

By introducing the concepts of gamification and instant gratification into every day personal banking experiences the Perx Loyalty Engagement Platform and Jenius aim to transform and uplift the quintessential thought relationship a consumer has with his or her lifestyle banking needs.

With a diverse array of rewarding experiences, gamified savings milestones and a personalized loyalty program that keeps rewarding customers for their every action, Jenius aims at driving positive behavioral hacks into the community such as building a nest egg or better managing impulsive spending habits with full transparency.

Moving away from existing as ‘just another digital bank’ and transforming into a financial solution for the digital savvy audience Jenius aims to engage its customers beyond their regular banking needs by becoming an enabler to the lifestyle choices its customers make daily.

At the core of this partnership lies the goal to drive maximum customer lifetime value through a dynamic and rewarding loyalty program, mobile customer journeys studded with instant gratification and gamification allowing the bank to nudge and influence positive customer behavior.

Driving this customer experience focused personal banking model is an engagement strategy that is continuous and non-transactional. Powering this strategy through the various mobile-first services Jenius offers is the Perx Loyalty Engagement Platform.

“As a digital native bank, the app experience is paramount to Jenius’ success. By collaborating with Perx, we are able to leverage innovative technology to provide a fun, personalized, and rewarding experience across all customer touchpoints throughout their entire customer journey. This is essential to create retention, engagement, and customer-first service experience – which is ultimately what sets us apart from others in the industry,” said Febri Rusli, Digital Banking Product & Innovation Head at Bank BTPN.

“In the experience economy, digitally savvy consumers expect personalized and meaningful interactions that keep them excited enough to return. We are delighted to deliver these ‘Aha moments” in every customer journey a Jenius customer will experience going forward. We are thrilled to partner with Bank BTPN to create and deliver an engaging customer experience for everyone served by Jenius in Indonesia.” said Anna Gong, Founder and CEO, Perx Technologies.

“Jenius is embarking on one of the most exciting customer experience transformation projects I have seen and delighted that Jenius chose to partner with Perx.” said Jovin Shen, Global Sales Director at Perx Technologies.

About Perx

Perx is the world’s first intelligent and autonomous solution for customer engagement and loyalty. Powered by AI and data-driven insights, the Perx Connect+TM Loyalty Engagement Platform enables brands to engage customers in ways that are both deeply meaningful and monetizable. Headquartered in Singapore, the platform synergizes gamification, behavioral science, and advanced engagement mechanics to support brands in elevating customer actions and interactions using data-driven experiences.

By designing customized, incentive-driven journeys, Perx Technologies simplifies customer acquisition, activation, monetization, and growth, cultivating enduring loyalty and remarkable user experiences, and solidifying its position as an industry trailblazer. The API-first platform enables businesses to focus on use cases and creative engagements across a brand’s disparate marketing technology stack in a matter of minutes.

About Bank BTPN

PT Bank BTPN Tbk (Bank BTPN) is a foreign exchange bank and is a merger between PT Bank Tabungan Pensiunan Nasional Tbk (BTPN) and PT Bank Sumitomo Mitsui Indonesia (SMBCI) in February 2019. Bank BTPN serves various segments in the banking industry, from retail to corporate customers, including retirees, micro-, small- and medium-sized enterprises (MSME) and productive underprivileged communities; the consuming class segment; and the corporate segment. Bank BTPN provides the services through business units, such as BTPN Sinaya—a business unit for wealth management, BTPN Purna Bakti—a business serving retirees, BTPN Micro Business—a business unit serving microbusinesses, BTPN Business Banking—a business serving small- and medium-sized enterprises, Jenius—a digital banking platform serving the consuming class segment, and the corporate business unit, which serves national, multinational, and Japanese companies. Bank BTPN also has a subsidiary, namely PT Bank BTPN Syariah Tbk, which focuses on serving productive underprivileged customers. Bank BTPN also regularly provides training sessions and information for customers through the Daya Program—a sustainable and measurable empowerment program—to improve customers’ capacity so they can grow and have a chance to live better.

Customer Acquisition, First-Party Data, Instant Gratification

Strategy Insights, Blogs, Retailers

Customer Engagement, Gamification, Customer Acquisition

Customer Engagement, Customer Acquisition, Brand Awareness

Customer Engagement, Customer Acquisition, Brand Awareness

eMind™ Early Adopters Program

Connect+ Expert

Impact Dashboard

Conversational Insights

Spark Ideas

No-code CX Builder

Perx Orion represents the next leap in loyalty engagement…

Integrating cutting-edge AI, Automation, Conversational Insights, and much more!

The early adopters program allows participants to trial the new features for 30 days.

The program is open to current Perx customers who are interested in testing and providing feedback on the new features.

The program includes access to the Impact Dashboard, Conversational Insights, Connect+ Expert, Spark Ideas, and the No-Code CX Builder.

No, participation in the early adopters program is free of charge for the duration of the program.

Participants can provide feedback through regular check-ins with the Perx support team and by completing surveys at the end of the trial period.

After the trial period, participants will have the option to continue using the features via a user-based (by seats) subscription plan for each feature.

Introducing the World’s First Autonomous Loyalty Solution

Elevating Customer Connections Through Gamified Experiences

Redefining Loyalty with Gamification and Behavioral Intelligence

Redefining Loyalty with Gamification and Behavioral Intelligence

Elevating Customer Connections Through Gamified Experiences

Redefining Loyalty with Gamification and Behavioral Intelligence

Trusted by

Unleash your engagement superpowers

Leading telecom serving 90M customers boosts customer actions through gamification.

15M brand interactions created

Leading bank engages 4M+ customers with 15M interactions in one year.

25%

221K

Over $18M in incremental revenue

Leading bank increases overseas spending by high-end credit card customers.

4.8M

CONNECT ALL YOUR DATA

Seamlessly integrate with your favorite tools

CRM, CDP & CEPs

& more

< Back

Marketing Automation

& more

< Back

Data & Analytics

& more

< Back

You’re in good company

StarHub

The platform has enabled us to create an instantly rewarding digital banking experience. Perx is deepening our relationship with our customers through an immersive and rewarding user experience

Our partnership with Perx was deeply influenced by their standout experience in banking and progressive customer engagement and monetization platform.

We see Perx not just as a service provider but as a key partner whose platform will enrich our digital banking services, offering our customers a genuinely rewarding experience.

Perx is set to supercharge our customer loyalty and engagement programs for our award-winning Care+ mobile app. Perx will help us drive positive customer behaviour with a purpose and for social good

Global businesses have driven over 5 billion

customer-brand interactions on Perx.

Live Webinar

Thu, May 30th | 14:00 – 14:45 (SGT UTC +8)

In This Webinar

![]() How Perx Orion™ Disrupts the existing loyalty framework

How Perx Orion™ Disrupts the existing loyalty framework

![]() Loyalty Engagement ROI with AI, Automation and Consulting

Loyalty Engagement ROI with AI, Automation and Consulting

Connect+™: Loyalty Engagement Platform

eMind™: AI-led, Data-driven Actionable Insights

ImpactLab™: Creative Strategy Consulting Think Tank

![]() Loyalty Engagement ROI with AI, Automation and Consulting

Loyalty Engagement ROI with AI, Automation and Consulting

Connect+™ Loyalty Engagement Platform

eMind™ AI-led, Data-driven Actionable Insights

ImpactLab™ Creative Strategy Consulting Think Tank

![]() Exclusive preview of Perx eMind™ – All things AI

Exclusive preview of Perx eMind™ – All things AI

20A Tanjong Pagar Road

Singapore 088443

Redefining Loyalty with Gamification and Behavioral Intelligence

Redefining Loyalty with Gamification and Behavioral Intelligence

Redefining Loyalty with Gamification and Behavioral Intelligence

Elevating Customer Connections Through Gamified Experiences

Redefining Loyalty with Gamification and Behavioral Intelligence

Redefining Loyalty with Gamification and Behavioral Intelligence

Elevating Customer Connections Through Gamified Experiences

Redefining Loyalty with Gamification and Behavioral Intelligence

Trusted by

Unleash your engagement superpowers

Leading telecom serving 90M customers boosts customer actions through gamification.

15M brand interactions created

Leading bank engages 4M+ customers with 15M interactions in one year.

25%

221K

Over $18M in incremental revenue

Leading bank increases overseas spending by high-end credit card customers.

4.8M

CONNECT ALL YOUR DATA

Seamlessly integrate with your favorite tools

CRM, CDP & CEPs

& more

< Back

Marketing Automation

& more

< Back

Data & Analytics

& more

< Back

You’re in good company

StarHub

The platform has enabled us to create an instantly rewarding digital banking experience. Perx is deepening our relationship with our customers through an immersive and rewarding user experience

Our partnership with Perx was deeply influenced by their standout experience in banking and progressive customer engagement and monetization platform.

We see Perx not just as a service provider but as a key partner whose platform will enrich our digital banking services, offering our customers a genuinely rewarding experience.

Perx is set to supercharge our customer loyalty and engagement programs for our award-winning Care+ mobile app. Perx will help us drive positive customer behaviour with a purpose and for social good

Global businesses have driven over 5 billion

customer-brand interactions on Perx.

Request a Demo

Let’s start creating delightful journeys!

Trusted by

Perx Technologies Pte Ltd

20A Tanjong Pagar Road

Singapore 088443

An ISO/IEC27001:2013 and ISO 27018:2019 compliant cloud solution

© 2025 Perx Technologies. All rights reserved.

© 2025 Perx Technologies. All rights reserved.

Hey! Shashank