Attracting digital natives in a mobile-first, instant gratification economy

Attracting digital natives in a mobile-first, instant gratification economy

Connections between companies and their customers are going digital. This isn’t the kind of shift that business can or should try to counteract — rather, they should start searching for the best ways to make these mobile-driven online connections flourish.

Both sides of the customer-business divide are digital natives. Today’s young consumers have grown up in a connected world, able to search out any information they need from their smart devices. Start-ups, too, have come of age in a digital world, rising rapidly using cloud technology and often preferring to market their products and services via mobile means.

The fast-moving world of always-on connectivity and instant gratification is the new battlefield where companies have to compete for consumers’ loyalty. Organizations that are able to adopt this mindset and give customers the compelling digital experiences they’re looking for are well equipped to become leaders in their fields.

Attracting young customers’ attention

Using a smartphone to interact with a brand isn’t like sitting at a computer. While today’s phones are capable of delivering powerful web browsing experiences, the sheer fact that they’re portable means people will often interact with them for short moments in time.

Picking up a smartphone while riding public transit, walking or getting lunch may lead to a very short interaction — if an activity takes a long time to accomplish, a phone user may skip it. This means that bands hoping to reach young consumers primarily through mobile devices must focus on memorable experiences that can be completed in seconds.

Getting a brand’s audience to commit to an ongoing loyalty and rewards program when interactions are so short and attention spans are so fractured is a unique kind of challenge. Making a positive first impression on customers is a key best practice in this regard.

What should that first interaction entail? The consumer should receive a reward or incentive they actually care about, something that has value. Even though it may seem tempting to give out very small amounts of points at first, to ensure consumers have to come back and earn more, such a withholding approach may simply cause customers to become bored and disengage.

In addition to having value, the engagement should also be gamified. This means it will have some fun, game-like characteristics, such as making progress toward an objective or earning a spot on a public leaderboard.

Finally, every quick interaction should be part of a unified customer experience. CMSWire noted that when brands take their CX seriously, they build long-term connections with their audiences. People who receive consistent messaging from a brand through every channel — in-person, online and mobile — will feel more comfortable continuing to engage with that business.

Keeping digital natives loyal

Once smart device users have had one good interaction with a company, it’s up to the brand to keep bringing those consumers back for more. They can make this easier by not creating barriers between audiences and the business

If people have ways to keep interacting with companies in ways that don’t involve spending any money, that helps the connection between the two parties flourish. This may mean granting badges, and allowing consumers to rise in rankings and creating gamified point systems that reward touches and engagements rather than purchases.

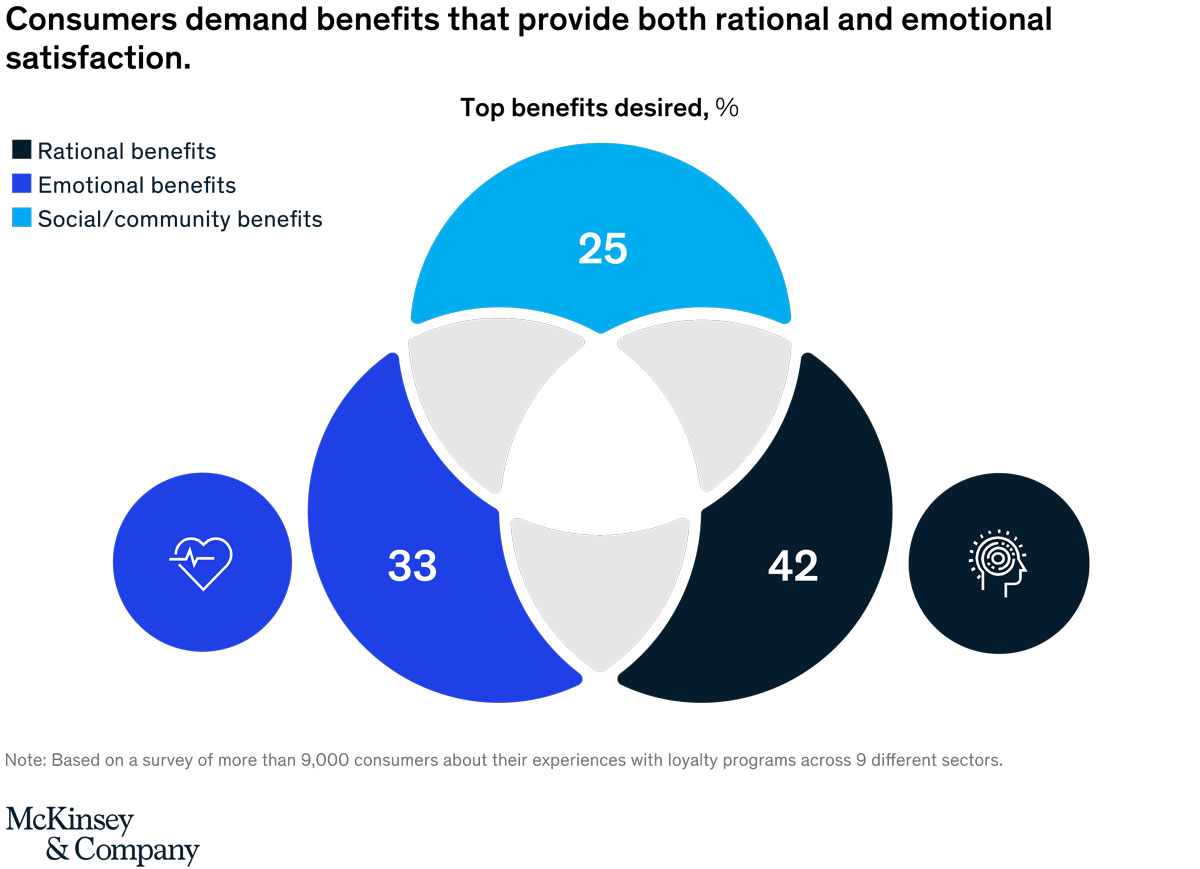

In addition to creating more possible engagements, customization may be a key part of the ongoing interaction between consumers and brands. MasterCard noted that in the digital age, people are not as willing to select rewards from a long list — this is a time-consuming interaction, and it may drive customers away. Rather, brands should be using the data generated by interactions to personalize rewards individuals will like and offer those.

Distinctive, customized interactions leading to personalized, data-driven digital rewards are the backbone of a loyalty program that can win over young, digital-native consumers.

Turning loyalty into ROI

Ongoing, non-monetary contact with customers doesn’t automatically turn into value, but businesses that commit to such a strategy can use it to nudge their audiences in the direction of a purchase. One of the valuable traits of a data-driven and automation-heavy digital rewards program is that it evolves over time. This can culminate in suggesting more direct commercial engagement.

A gamified customer journey that starts with simple mobile interactions can lead to a more all-encompassing connection between shopper and company. As Mondia Digital CEO Paolo Rizzardini suggested on his LinkedIn blog, gamification can set the stage for a long-term bond between these parties, with the highly engaged consumers speaking positively about the brand and reengaging often.

A loop of positive engagements, powered by evolving rewards, can build up loyalty and keep customer relationships strong over time. Rizzardini pointed to the Nike Run Club app and the Starbucks loyalty points system. Both programs use gamified interactions to keep users’ attention for the long term.

The common thread between compelling customer loyalty programs in the digital age is that they don’t demand much of consumers. Interactions with companies’ mobile-first digital tools are fun and enjoyable, and often don’t require a purchase. Audiences can stay in touch with the businesses, earning customized rewards and building positive associations — then, when it’s time to buy, they know where to turn.

Perx is the right rewards platform for digital natives

The right rewards platform is an essential piece of technology to connect digital-native companies with digital-native consumers. The Perx Loyalty Engagement Platform is the right solution for the modern, fast-moving customer relationships because of its comprehensive, future-minded feature set.

From gamified experiences and non-monetary rewards to powerful automation tools and a high degree of customization, the system is a compelling choice for businesses hoping to become more tech-forward and mobile-centric. Campaigns can naturally evolve over time, keeping users interested with fun interactions, then guiding them to commercial sites when the time is right.

In a world of short attention spans, it is possible to hold customer attention for a long time. Businesses simply have to know how to string countless small moments together into ongoing relationships. Request a demo to learn more.

Recommended for you

Blogs, Customer Engagement, Game Theory

Blogs, Personalization, Customer Retention

Customer Acquisition, Engagement, Personalized Rewards

Customer Engagement, Customer Acquisition, Digital Banking

Blogs, Digital Onboarding, Digital Transformation

Global businesses have driven over 5 billion customer-brand interactions on Perx.

Ready to join them?