Indonesia’s Commonwealth Bank Chooses Perx Technologies To Transform Customer Acquisition and Engagement

Home > In The News >

SINGAPORE, 11 MAY, 2021 – PRESS RELEASE

Indonesia’s Commonwealth Bank Chooses Perx Technologies To Transform Customer Acquisition and Engagement

SINGAPORE, 11 MAY, 2021 – PR

Indonesia’s Commonwealth Bank Chooses Perx Technologies To Transform Customer Acquisition and Engagement

Perx Technologies, a category creating Lifestyle Marketing SaaS Platform provider today announced its strategic partnership with PT. Bank Commonwealth (PTBC), a subsidiary of Commonwealth Bank of Australia (CBA), the largest financial institution in Australia. This partnership complements PTBC’s newly introduced mobile banking application, CommBank Mobile, to drive higher customer growth and engagement through the digitalisation of its customer acquisition, and loyalty and rewards management initiatives.

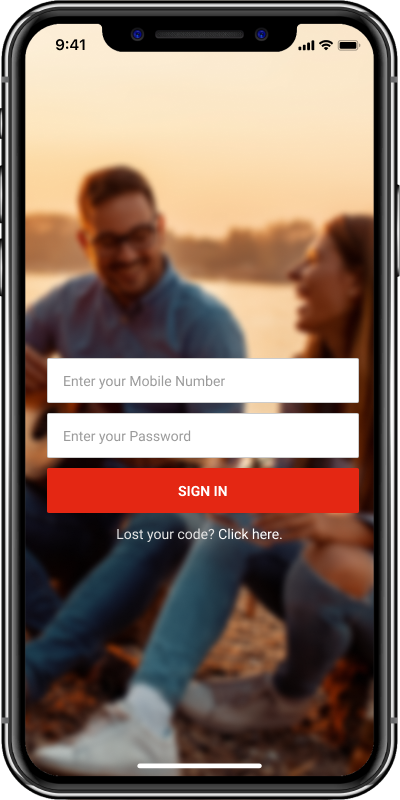

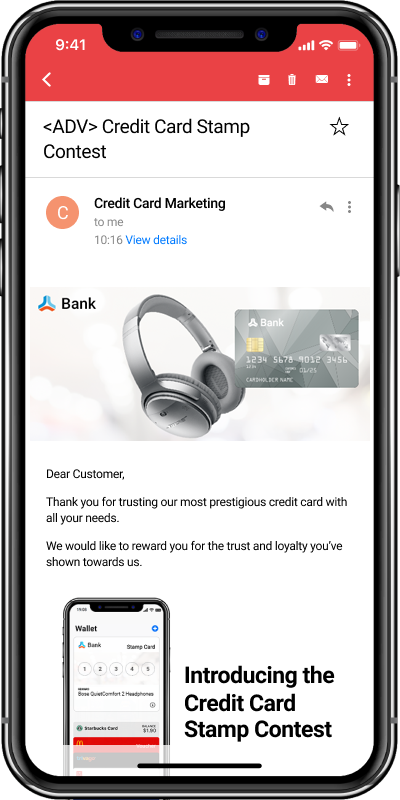

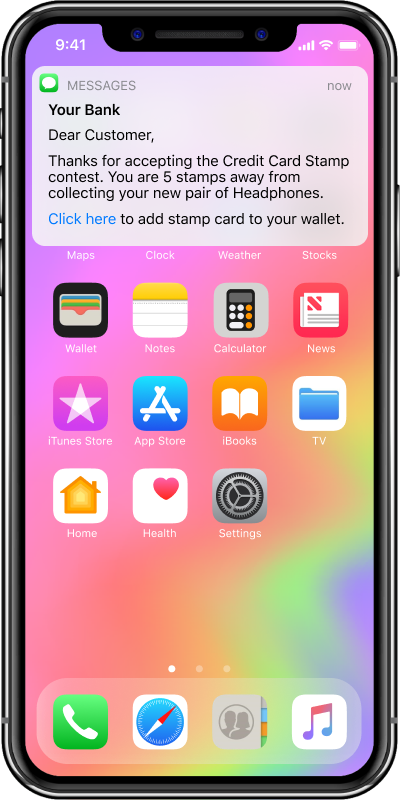

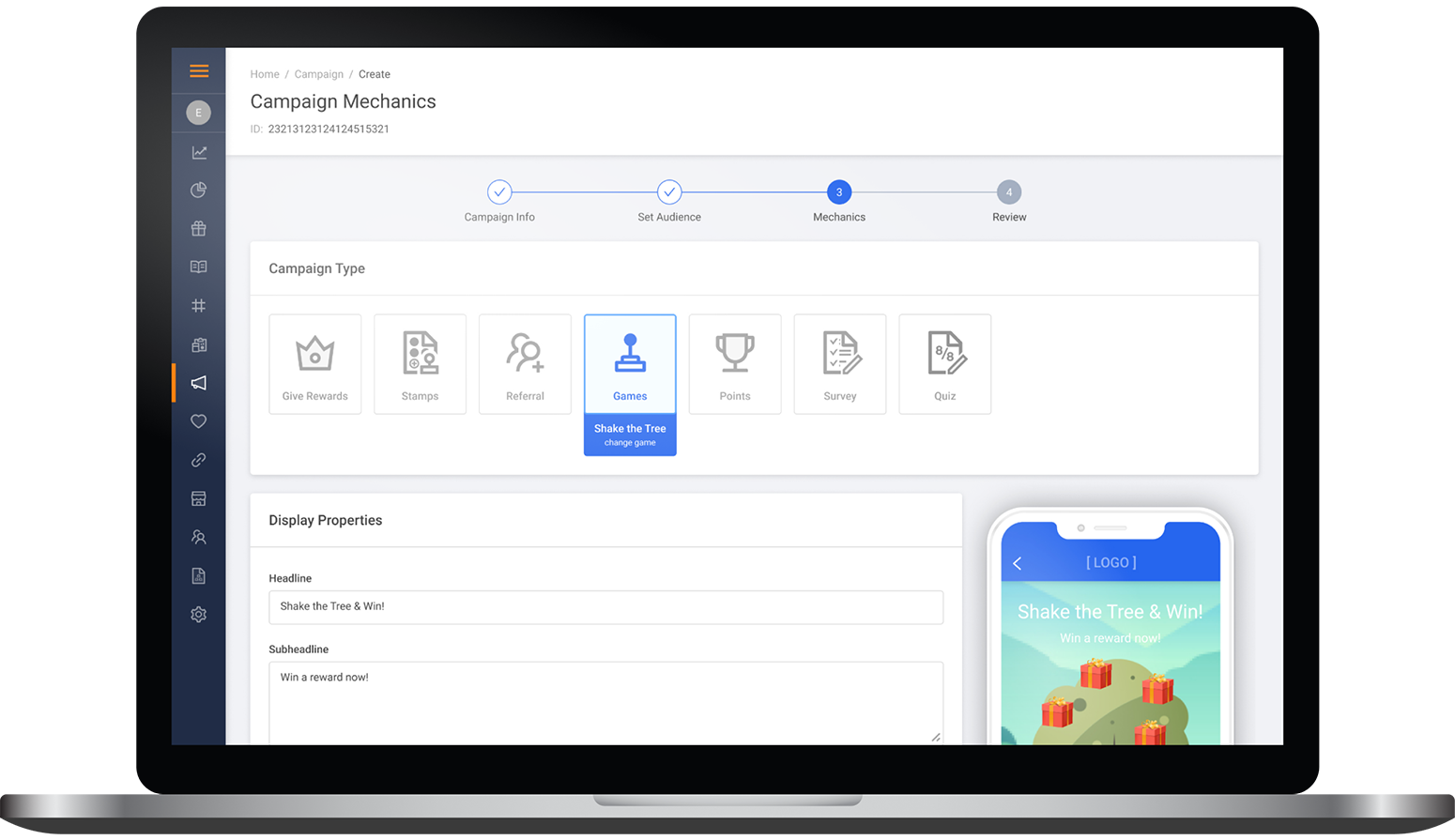

PTBC’s transformation journey from a traditional bank to a digital-first bank puts greater emphasis and importance on a seamless customer experience and engagement. To support its customer acquisition strategy, PTBC will leverage Perx’s Loyalty and Engagement Platform to deliver personalised and gamified engagements that reward customers for specific actions and interactions.

“This partnership with PTBC signals trust from yet another digital leader in the banking industry,” said Anna Gong, Founder, and CEO, Perx Technologies. “The Perx platform was purpose-built for large enterprises, investing in mobile-led and data-driven approaches. The primary driver has been to creatively connect with customers and drive change in customer behaviour through dynamic last-mile engagements, whilst boosting revenue and improving customer experience through instant gratification. This has been a key differentiator for us, and we are thrilled to support PTBC in its journey to further improve its engagement with its customers.”

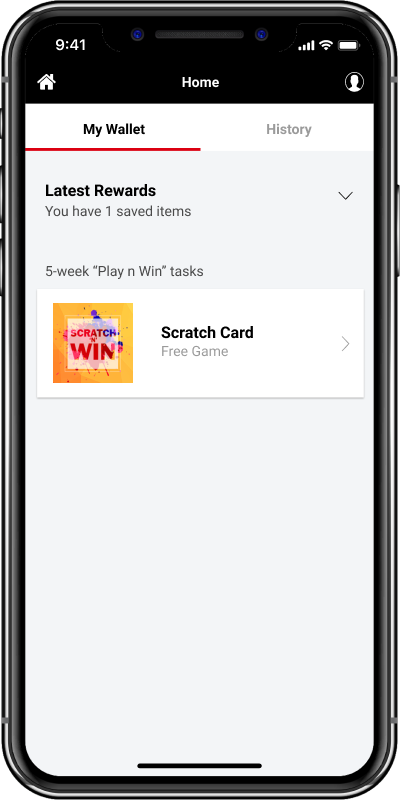

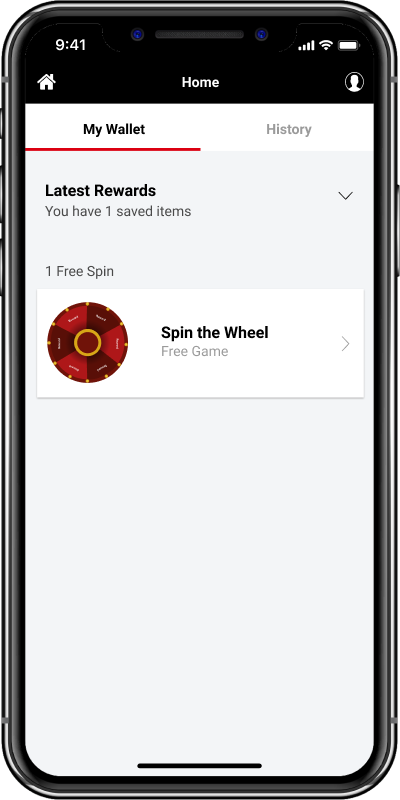

Following the successful launch of its digital e-kiosk in 2017 – Indonesia’s first fully digital self-serving kiosks that allow customers to open their bank accounts in under ten minutes, PTBC has just launched its new mobile banking app, CommBank Mobile. CommBank Mobile has been designed to help its users better manage their finances and achieve their goals with features including its easy-to-use expense tracking function and its Goal Saver product. Combined with these features, CommBank Mobile will leverage the Perx platform’s unique engagement mechanics and gamified experiences to increase last-mile customer engagements by incentivising day-to-day customer actions with personalised rewards.

“Perx Technologies will be one of the key enablers for us to achieve our customer acquisition targets through gamified engagements that deliver relevant and personalised rewards for customer actions. Perx’s deep domain expertise in the banking and financial services sector, and its end-to-end customer data and engagement platform are a great match for our customer acquisition and retention needs at PTBC.” said Ming Chen, Director of Digital & Strategy at PT. Bank Commonwealth.

“As we demonstrated in the past with our digital innovations, which has included the digital e-Kiosk, and the SmartWealth app – our award-winning wealth management mobile application, PTBC is committed to continuing its digital transformation journey. The CommBank Mobile app is the next evolution of that journey and will ensure Commonwealth Bank continues moving towards its purpose: ‘to improve the financial wellbeing of our customers and communities’.” Ming added.

With rewards programs usually taking weeks to set up, implement and curate, Perx’s Loyalty and Engagement Platform will enable PTBC to run multiple reward campaigns concurrently that appeal to their customers and efficiently meet business objectives. Other big brands who trust Perx Technologies to help yield better last-mile customer engagement include StarHub, HSBC, UOB, Digi Telecom, DBS and Razer Fintech.

About Perx Technologies

Singapore-based Perx Technologies is a category-creating Lifestyle Marketing SaaS Platform helping large enterprises and digital native businesses transform from transient and transactional brands to delivering continuous and meaningful customer engagements in the digital economy. Powering large regional and global brands, the platform enables organizations of all sizes to monetize on customer engagements by creating personalized, interactive revenue-generating digital experiences for millions of end consumers.

For more information, please visit: https://www.perxtech.com

About PT Bank Commonwealth

PT. Bank Commonwealth (“Commonwealth Bank”) is a subsidiary of the Sydney based Commonwealth Bank of Australia (CBA), the largest financial company listed in Australia Securities Exchange (ASX). Commonwealth Bank focuses on both the Retail and SME segments, providing a full range of banking products and services – as well as being a leading provider of Wealth Management – by offering tailored financial solutions to serve customers’ needs.

For more information, please visit: https://www.commbank.co.id/en